Posts

Loans are permitted only if you get effectively linked money. If you did not have an SSN (otherwise ITIN) provided for the otherwise before the deadline of one’s 2024 go back (in addition to extensions), you can’t allege the child income tax credit to your either your brand-new or an amended 2024 return. You may also be eligible for that it borrowing from the bank (called the brand new saver’s borrowing) for individuals who made qualified efforts to a manager-sponsored later years package or perhaps to an enthusiastic IRA inside the 2024. To learn more in regards to the criteria to claim the financing, come across Club. When you are a citizen alien, a great qualifying founded comes with your being qualified kid or qualifying relative.

Even as we get secure commissions of names noted on this site, all of our reviewers’ opinions are often their and so are maybe not swayed from the financial aspect in in whatever way. Our writers comment the new names on the player’s position and provide their own feedback, you to definitely continue to be unedited. This enables us to publish goal, objective and you may correct analysis. One another to find short-term abode and you can long lasting residence, there is no minimal money specifications. Brief residency provides the ability to alive and you may work in Paraguay, as well as getting subject to Paraguayan taxes for 2 years.

So what can a landlord subtract of shelter deposits?: lucky 88 for real money

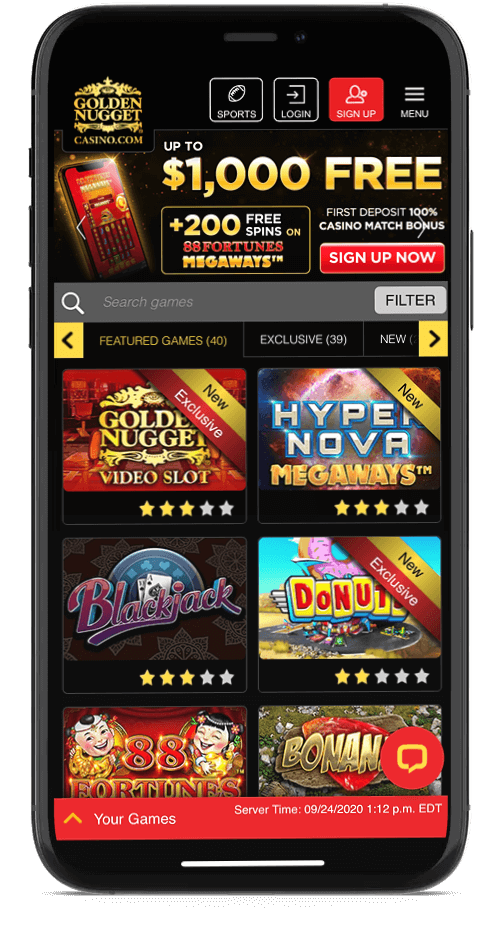

It is rather important that you realize your gambling enterprise’s fine print ahead of registering otherwise making in initial deposit, you know precisely what you are getting into and you may pick the best gambling enterprise for you. In case your gambling enterprise have a plus readily available that comes with free spins, I don’t see the reason your shouldn’t be capable of geting her or him, so long as you meet the local casino’s requirements. When you can also be content which list wholesale, we recommend paying attention to your regional business. Once you learn for an undeniable fact that your own hardwood boy charges $1,100 for every area, generate you to known to your own tenant. The more accurate you will be today, the newest fewer shocked tenants you’ll handle later on.

$5 Minimum Put Casino NZ – Deposit 5 rating one hundred 100 percent free revolves

Your own tenant accounts for a complete cost of unpaid rent and injuries, even if the put isn’t sufficient. Always, a month’s book is standard, however in large-demand section, you happen to be capable request more. An appropriate security deposit count depends on their local rental’s location and you will condition laws. Sometimes, renters might inquire to make use of section of their put for rent, brief fixes, or even shelter outstanding bills while they are quick to your dollars. Taking your new target is one of the most very important shelter deposit laws that you must pursue.

Another discussions will assist you to know if money you will get within the income tax season try effortlessly linked to a great U.S. change or team and just how it is taxed. That it different does not apply to settlement for functions did on the foreign flights. The lucky 88 for real money choice to end up being addressed while the a resident alien is suspended for tax seasons (pursuing the taxation 12 months you made the possibility) if neither companion is a U.S. resident otherwise citizen alien any moment inside taxation year. It means for each companion have to document a new go back while the a great nonresident alien regarding 12 months if the sometimes matches the brand new filing requirements to possess nonresident aliens chatted about within the a bankruptcy proceeding. Nonresident alien people from Barbados and you can Jamaica, and students from Jamaica, could possibly get be eligible for an enthusiastic election getting treated as the a citizen alien to possess You.S. tax aim under the You.S. taxation treaties that have those individuals nations. For many who be eligible for so it election, you could make it from the submitting a form 1040 and you will attaching a signed election statement to your get back.

Programs including Qira give big advantageous assets to both people and possessions managers. Residents can continue more income in their purse, and you can property executives don’t have to assume any extra exposure—Qira protects they to them. Possessions executives are allowed to charges to possess shelter deposits and/or very first few days’s lease initial, however they might no expanded costs accommodations app percentage. Also, they are prohibited to costs flow-inside charges or circulate-aside charge.

To help you claim the brand new deduction, enter a good deduction from $step three,one hundred thousand otherwise smaller on the web 15b otherwise a good deduction out of a lot more than just $step 3,100 on the web 15a. If the fiduciary elects to take the financing as opposed to the deduction, it has to use the California income tax rate, range from the borrowing add up to the full online 33, Total Repayments. To the left for the full, make “IRC 1341” and also the quantity of the credit. Go into the total taxable earnings perhaps not claimed in other places to your Side 1. Look at the container when it Function 541 will be recorded since the a safety claim to have reimburse.

For many who amend Mode 1040-NR otherwise document a correct go back, enter “Amended” along the finest, and you may install the newest remedied go back (Function 1040, 1040-SR, otherwise 1040-NR) to create 1040-X. Normally, an amended go back stating a refund should be submitted in this step three years in the time your go back try submitted or in this 2 decades since the newest income tax try paid back, any kind of is actually afterwards. Money filed until the final deadline is recognized as in order to was recorded to the deadline. Once you fill in your taxation return, get extra care to enter the correct quantity of one income tax withheld found on your suggestions files. Next desk lists a number of the more prevalent suggestions data files and you can reveals how to locate the degree of income tax withheld. To allege the brand new adoption credit, file Form 8839 along with your Mode 1040-NR.

Checking account makes it possible to manage your cash in flexible implies. Start with Financial Intelligently Examining to help you discover rewards and extra pros as your balances grow. Merely browse up and to get our set of an educated $5 deposit gambling enterprises within the Canada. The members which sign in from the Jackpot Area can be found a pleasant extra all the way to $1,600.